Engagement Model

Expertise

Generative and Agentic AI Development

Build intelligent, adaptive, and creative AI systems that think, act, and innovate with you.

Web Development

Crafting digital solutions that help you convert visitors into customers.

Mobile Development

Go mobile-first with responsive apps for collaboration and digitizing workflows.

DevOps

Unleash resilience with robust practices for unparalleled software excellence.

Data Analytics

Turn raw data into actionable insights for driving strategic decisions.

Low-Code/No-Code

Achieve scalability, cost-effective agility while empowering non-tech teams.

E-Commerce Development

Create an online presence that helps you drive engagement and conversion.

UI/UX Design

Harmonizing your brand with intuitive designs for usability, putting users first.

Software Testing

Pinpoint software defects swiftly with our expert testing approach.

Cyber Security

Get 360º cyber security protection for your organization.

Industries

As a digital partner, we empower businesses with user-centric solutions.

FinTech

Craft and engineer innovative tech upgrades in all things fintech.

Healthcare

Improve and enhance healthcare stakeholder experience—be it patients or doctors.

EdTech

Evolve and empower education seamlessly through our tech-driven solutions.

HRTech

Transform your work teams through tailored software solutions for seamless excellence.

Real Estate

Elevate and enhance your real estate presence with our tech solutions.

Travel

Boost travel outcomes and customer satisfaction with our tech developments.

Oil and Gas

Digitizing and optimizing your oil and gas operations with our tech expertise.

Electronics and Communication

Fortify your business with next-gen electronics & communication solutions.

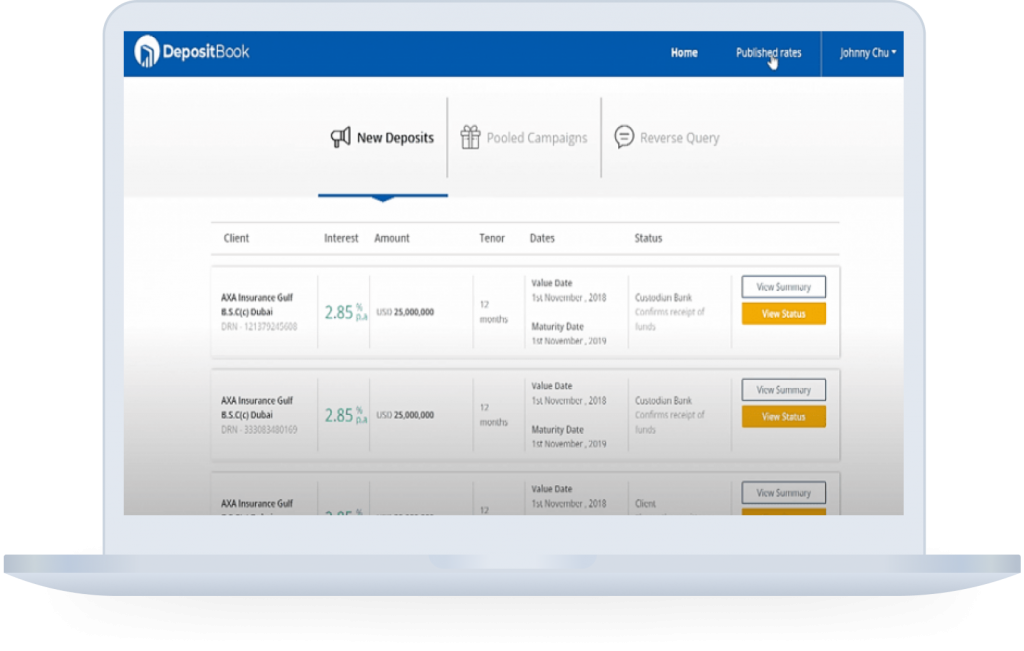

Overview

Deposit Book, an online platform connecting banks and depositors globally for high-value deposits, faced performance and security challenges. Ajackus stepped in as the technology partner to enhance the platform’s speed and address security issues. We strengthened Deposit Book, ensuring a secure and efficient platform for seamless interactions and transactions in high-value deposits.

Problem

- Global Wholesale Deposit Marketplace

Deposit Book is a global wholesale deposit marketplace, connecting Partner Banks, Depositors, Client Banks, and Custodian banks worldwide. Despite this, the existing system faced performance, security, and user experience challenges that impacted the business.

- Prolonged System Issues

Deposit Book’s current system proved prolonged, hindering a seamless user experience. Recognizing the necessity for improvement, they enlisted Ajackus to conduct a thorough audit and address the ongoing issues.

- Performance and Security Problems

Deposit Book encountered performance and security problems, affecting the platform’s efficiency and user trust. Collaborating with Ajackus, they aimed to resolve these issues and create a more robust, secure, and user-friendly deposit marketplace for global stakeholders.

Solution

- Codebase Audit and Performance Enhancement

We conducted a thorough codebase audit for Deposit Book, identifying critical issues: performance problems, over-normalization, and redundant backend code, resulting in 210 REST API endpoints. By denormalizing tables and refactoring code, we significantly enhanced platform performance.

- Security Issue Resolution

During the security audit, we addressed multiple issues for Deposit Book, including Sensitive Information Disclosure, Insecure Transport Layer Protection, Insecure File Upload, and Sensitive Information in GET Requests. Our efforts ensured a secure platform environment.

Results

In just 12 weeks, we improved their system security and sped up performance by optimizing the database structure and reducing API endpoints from 210 to 155. After that, Deposit Book got regulatory approval from the UK’s Financial Conduct Authority (FCA) and partnered with Fintuitive, a UK-based fintech. This partnership allows Fintuitive’s institutional clients to access worldwide cash deposits and other products from banks.

14+

Years of Engineering Depth

300+

Projects delivered

1B+

in Client Value Created

You may also like

Let’s Build your Project Together

Fill out the form, and our growth experts will get back to you within 1 business day.