Brands That Love Us

Why Use Fintech Applications?

Choose finance apps for a hassle-free financial experience tailored to you. They simplify money matters, keep things secure, and offer real-time insights. With easy transactions and user-friendly mobile banking, managing your finances becomes a breeze, helping you make informed decisions for your financial well-being.

How Ajackus Can Empower?

Supercharge your financial startups with a comprehensive suite of services, including wealth management, data analytics, international money transfers, and more.

- In-depth Research and Analytics Tools

- Digital Payment Platforms

- Real-time Portfolio Management

- Payment Gateway Integrations

- Wealth Management Applications

- Data Management & Analytics

- Mobile Banking Applications

- Legacy System Modernization

- Payment Processor

- Investor Onboarding and KYC Solutions

- International Money Transfer Applications

- Digital Regulations & Compliance

Why Choose Our Expertise?

Step into excellence with us! Explore tailored solutions, innovation, efficiency, and strategic prowess. Choose success, choose our dedicated expertise.

Client-Centric Focus

We customize fintech solutions to match your needs, ensuring they align seamlessly with your business objectives for maximum impact.

Swift Deployment

We prioritize quick and efficient implementation, ensuring you swiftly benefit from the latest advancements in financial technology.

Strategic Innovation

We strategically innovate to anticipate future challenges, ensuring sustained relevance and success in the dynamic fintech landscape.

Responsive Development

We adapt agilely at every stage, ensuring effective and aligned fintech solutions for your evolving business goals.

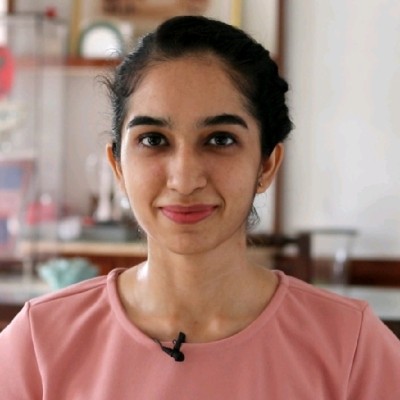

What our Clients are Saying

23 Reviews

FAQs

Banks utilize fintech to improve services and efficiency. Fintech enables digital payments, including mobile wallets, P2P transfers, and contactless transactions. Advanced algorithms assess risk for credit scoring and fraud detection, enhancing loan approvals and security. Automated investing services (robo-advisors) offer personalized investment strategies. Blockchain ensures secure transactions, especially in trade finance. APIs enable seamless integration with third-party fintech for expanded services, empowering banks to streamline operations and offer innovative, accessible financial services.

A significant challenge in fintech is navigating regulatory compliance and complex legal frameworks. Balancing innovation with adherence to stringent regulations like KYC and AML poses hurdles. Security concerns, amid digital transactions and cybersecurity threats, demand robust measures to safeguard financial data. Competition requires continuous adaptation and differentiation in a rapidly evolving landscape. Achieving scalability while maintaining user trust, ensuring data privacy, and fostering financial inclusion remains a critical balancing act for fintech firms.

Fintech, short for financial technology, is a sector within the broader financial industry. It encompasses innovative technologies and software to enhance and automate financial services. Fintech intersects with banking, investment management, insurance, and eCommerce. Leveraging advancements in mobile payments, blockchain, AI, and robo-advisors, fintech challenges traditional financial institutions. Its growth is fueled by venture capital, regulatory support, and increasing consumer demand for convenient, digital financial services. As technology evolves, fintech remains a dynamic space within the financial industry.

Fintech transforms consumer experiences by offering convenient, user-friendly financial services. From mobile banking apps to digital wallets, it simplifies transactions, provides personalized financial insights, and empowers users with efficient tools for budgeting and investing.

Artificial Intelligence (AI) is integral to Fintech, powering advanced algorithms for risk assessment, fraud detection, and personalized financial recommendations. AI enhances decision-making processes, enabling quick and accurate credit scoring, automating investment strategies, and ensuring the security of digital transactions.

Fintech’s growth is propelled by various factors, including increasing smartphone penetration, evolving consumer expectations for seamless digital experiences, regulatory support fostering innovation, and strategic partnerships between traditional financial institutions and fintech startups. These drivers contribute to the ongoing expansion and diversification of the fintech landscape.