Overview:

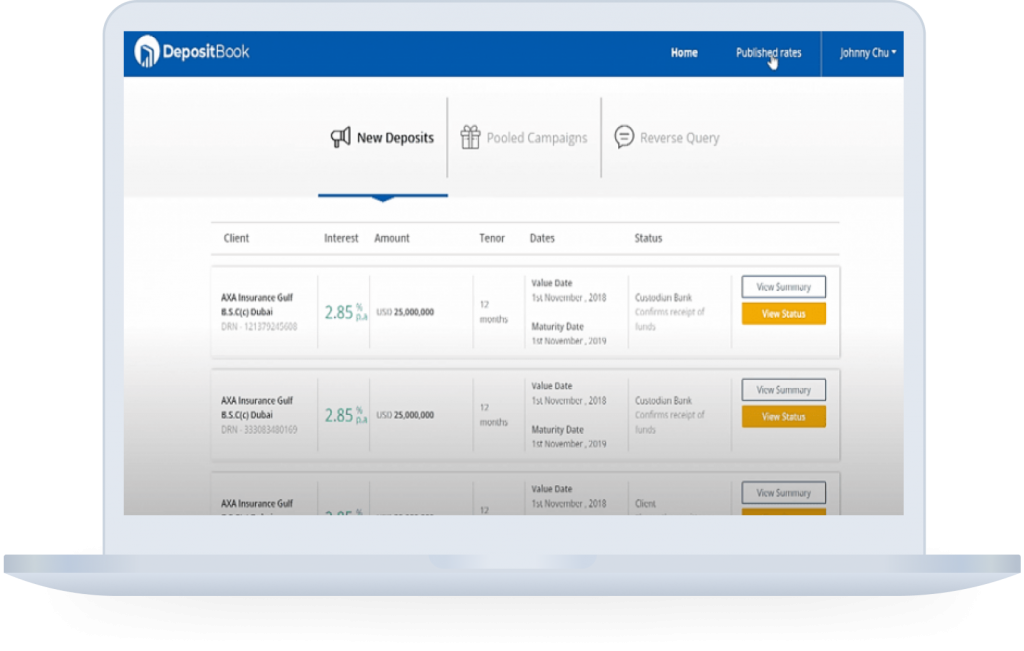

Deposit Book, an online platform connecting banks and depositors globally for high-value deposits, faced performance and security challenges. Ajackus stepped in as the technology partner to enhance the platform’s speed and address security issues. We strengthened Deposit Book, ensuring a secure and efficient platform for seamless interactions and transactions in high-value deposits.

Problem

- Global Wholesale Deposit Marketplace

Deposit Book is a global wholesale deposit marketplace, connecting Partner Banks, Depositors, Client Banks, and Custodian banks worldwide. Despite this, the existing system faced performance, security, and user experience challenges that impacted the business.

- Prolonged System Issues

Deposit Book’s current system proved prolonged, hindering a seamless user experience. Recognizing the necessity for improvement, they enlisted Ajackus to conduct a thorough audit and address the ongoing issues.

- Performance and Security Problems

Deposit Book encountered performance and security problems, affecting the platform’s efficiency and user trust. Collaborating with Ajackus, they aimed to resolve these issues and create a more robust, secure, and user-friendly deposit marketplace for global stakeholders.

Solution

- Codebase Audit and Performance Enhancement

We conducted a thorough codebase audit for Deposit Book, identifying critical issues: performance problems, over-normalization, and redundant backend code, resulting in 210 REST API endpoints. By denormalizing tables and refactoring code, we significantly enhanced platform performance.

- Security Issue Resolution

During the security audit, we addressed multiple issues for Deposit Book, including Sensitive Information Disclosure, Insecure Transport Layer Protection, Insecure File Upload, and Sensitive Information in GET Requests. Our efforts ensured a secure platform environment.

Results

In just 12 weeks, we improved their system security and sped up performance by optimizing the database structure and reducing API endpoints from 210 to 155. After that, Deposit Book got regulatory approval from the UK’s Financial Conduct Authority (FCA) and partnered with Fintuitive, a UK-based fintech. This partnership allows Fintuitive’s institutional clients to access worldwide cash deposits and other products from banks.

12+

Years in the industry

300+

Projects delivered

500M+

End users impacted

You may also like

Contact us

Fill out the form and we will get in touch with you shortly.

12+

Years in the market

300+

Projects Delivered

500M+

End Users impacted