Brands That Love Us

How Can Digital Banking Software help?

Banking softwares streamline financial services, enhancing efficiency and customer experience. Through secure mobile apps and online platforms, users can manage accounts, conduct transactions, and access personalized insights. For instance, AI-driven financial apps offer real-time spending analysis, empowering users to make informed decisions and achieve financial goals effortlessly.

Ajackus: Your Tech Partner in Need

Partner with Ajackus for user-friendly custom software solutions. We simplify technology, boost efficiency, and improve user experience to elevate your business.

- Artificial Intelligence in Credit Scoring

- Automated Account Reconciliation Systems

- Cloud-Based Banking Solutions

- Virtual Branch Solutions

- Invoice Financing Software

- Digital Mortgage Processing Platforms

- API Integration for Financial Services

- Open Banking Platforms

- Peer-to-Peer (P2P) Lending Platforms

- Asset and Wealth Management Systems

- Enterprise Resource Planning (ERP) for Banks

- Digital Identity Verification Services

Why Choose Our Banking IT Solutions?

In a changing economy, our bank software engineers upgrade systems, improve user experience, cut technical debt, and boost competitiveness for financial institutions.

Scalability

Our solutions grow with your business, accommodating expansion and increased demands.

Digital Transformation

We help you embrace a seamless digital journey with our transformative IT solutions.

Integrated Communication

We facilitate smooth communication and collaboration across all banking channels.

Risk Mitigation

We take proactive measures to identify and manage potential risks in real-time.

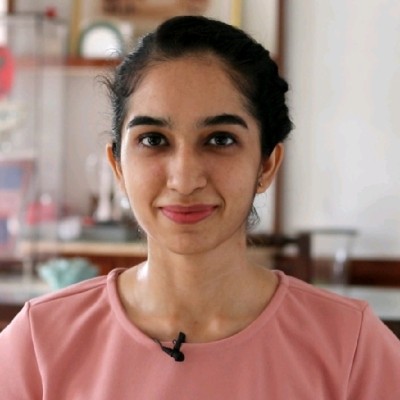

What our Clients are Saying

23 Reviews

FAQs

Data analytics in Banking Software Development plays a pivotal role in extracting actionable insights from vast amounts of data. Banks can use analytics to understand customer behavior, predict market trends, identify potential risks, and optimize operational processes. By leveraging data-driven decision-making, banks can enhance their competitiveness, improve customer satisfaction, and stay agile in a rapidly evolving financial landscape.

Digital banking tools provide banks with the means to offer a more convenient and personalized experience to customers. Features like mobile banking apps, online account management, and digital wallets enhance accessibility and ease of use. By incorporating these tools, banks can attract tech-savvy customers, retain existing ones, and differentiate themselves in a crowded market.

Implementing BPaaS may pose regulatory challenges related to data governance, privacy, and compliance with industry-specific regulations. Financial institutions need to conduct thorough due diligence to ensure that the chosen BPaaS solution adheres to regulatory standards. This may involve data residency considerations, compliance with data protection laws, and maintaining transparency in data handling practices.

AI in modern Banking Software serves various purposes, ranging from enhancing customer interactions to improving operational efficiency. AI-driven chatbots provide instant customer support, machine learning algorithms detect and prevent fraud, and predictive analytics help in anticipating customer needs. Overall, AI empowers banks to automate processes, reduce errors, and deliver more personalized and efficient services.