Brands That Love Us

How Can Banking Tools Online help?

Do you know bank tools could streamline your financial management? Access accounts, transfer funds, and monitor transactions effortlessly. Experience real-time updates, secure transactions, and personalized financial insights. From budgeting to bill payments, leverage user-friendly interfaces for a seamless banking experience. Optimize your finances with the power of online banking tools.

Your Tech Partner

Collaborate with Ajackus for custom software solutions that prioritize user-friendliness. We streamline technology, enhance efficiency, and elevate user experience to drive your business forward.

- Electronic Funds Transfer (EFT) Solutions

- Personal Finance Management Apps

- Credit Scoring Software

- Regulatory Compliance Solutions

- Biometric Security for Banking

- Real-Time Transaction Monitoring

- Data Analytics for Financial Institutions

- Customer Onboarding Software

- Multi-Currency Banking Software

- Chatbot Integration for Customer Support

- Investment Management Platforms

- Cybersecurity Solutions for Banking

Why Choose Our Banking Software Solutions?

Our team of banking software experts enhances systems, enhances user interactions, reduces technical burden, and enhances competitiveness for financial entities.

Rapid Digital Advancement

Start with a swift evolution with our intuitive solutions, securing a competitive advantage.

Effortless Integration

Streamline your onboarding procedures, saving time and enhancing the customer experience.

AI-Driven Customization

Allow us to craft personalized journeys using AI-driven insights and tailored services.

Preemptive Risk Oversight

Stay ahead with our proactive real-time risk management, guaranteeing compliance and business resilience.

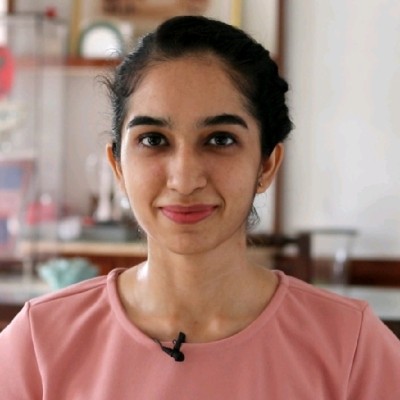

What our Clients are Saying

23 Reviews

FAQs

BPaaS is a cloud-based solution designed to offer financial institutions a comprehensive and integrated platform for delivering banking services. It combines various services, including core banking functions, customer relationship management (CRM), and digital banking tools. The cloud-based nature of BPaaS allows for scalability, flexibility, and efficient deployment of services without the need for extensive on-premises infrastructure.

Unlike traditional banking systems that often rely on on-premises infrastructure, BPaaS leverages cloud technology. This key difference enables financial institutions to reduce upfront infrastructure costs, achieve faster time-to-market for new services, and scale their operations more dynamically. BPaaS also promotes collaboration and innovation by providing a platform for seamless integration with third-party applications and emerging technologies.

Banking IT solutions encompass a wide range of features to meet the diverse needs of financial institutions. Core banking systems automate key processes like account management and transaction processing. Data analytics tools help banks gain insights into customer behavior, while cybersecurity solutions protect sensitive information. Regulatory compliance tools assist in meeting industry standards and legal requirements, ensuring a robust and secure IT environment for banking operations.

Banking software development tailors solutions to the specific requirements of financial institutions. This customization enhances efficiency by addressing unique challenges faced by banks. Whether it’s improving customer experience through intuitive interfaces or incorporating advanced technologies like artificial intelligence for predictive analytics, banking software development empowers institutions to stay competitive in a rapidly evolving industry.